Stewardship of 401(k) Plans

TRANSPARENCY, ACCOUNTABILITY AND OBJECTIVITY

We’ve built a forward-looking financial practice with a foundation of independence, technical skill and creativity. This allows us to be transparent and objective to help protect our community from the perils of a conflicted financial services industry. It provides us with a grounded philosophy to build upon in an ever-changing world.

TAO’S PROCESS

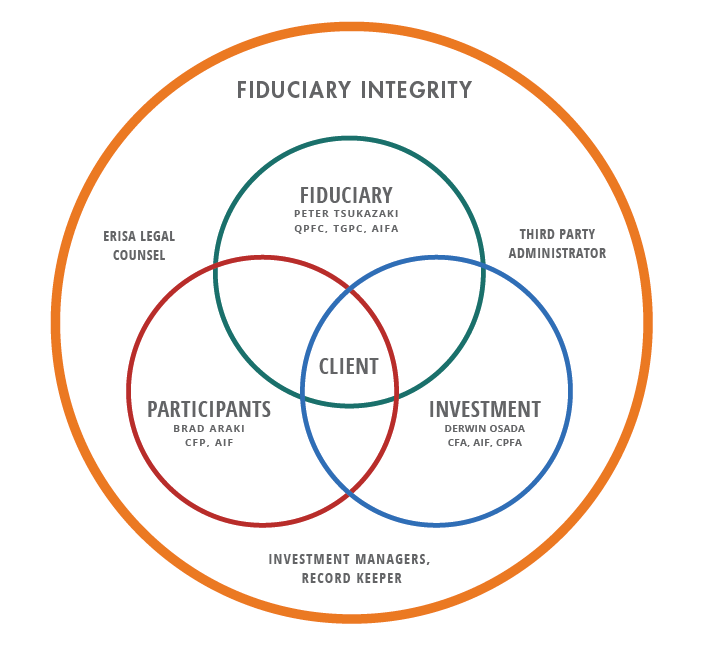

To reduce various service errors, we created a process with Fiduciary Integrity, an overlapping system of responsibility. This helps the plan sponsor in understanding the cycle of a fiduciary and governance process.

KEY PRINCIPLES

- Raise the standard of care to better serve participants by pursuing prudence and integrity

- Use a process that is coherent, cohesive and compliant

- Build key industry relationships to support our knowledge and vision

- Perform in-house integration of vital services using best practices for clients

- Leverage service providers to maximize operational efficiencies, streamline processes, and decrease costs

Why It’s Important

THE EXISTING 401k INDUSTRY MODEL IS IMPERFECT

With the need for more sales in the ‘80s, pension industry investment giants created the opportunity for the coming decades with the “new 401(k) plans”. Products and features were sold to plan sponsors, so compliance remained in the fine print. Today, a lot has changed with the products and features, but plan sponsors are only beginning to delve deeper into understanding their responsibilities and what oversight means. To this end, it is common for 401(k) plans to experience unintentional errors. With service providers delivering inconsistent levels of service it is paramount that compliance should be THE focus in protecting plan sponsors and participants.

MANY PLAN PARTICIPANTS ARE NOT READY FOR RETIREMENT

Our experience reveals that much more emphasis should be placed on deferrals than investments and younger employees need to understand that they have the advantage of “time”. Even though financial education and tools have significantly improved, it has not translated into higher deferral rates.

TAO WAS DESIGNED WITH INTEGRITY

Our firm was created specifically to provide fiduciary services to 401(k) Plan Sponsors in a caring, objective, and independent way. We understand the high standard of care required to serve as the caretaker and steward for your company’s retirement plan. We provide both the compliance assistance that plan sponsors need as well as the down-to-earth consultation that participants desire.